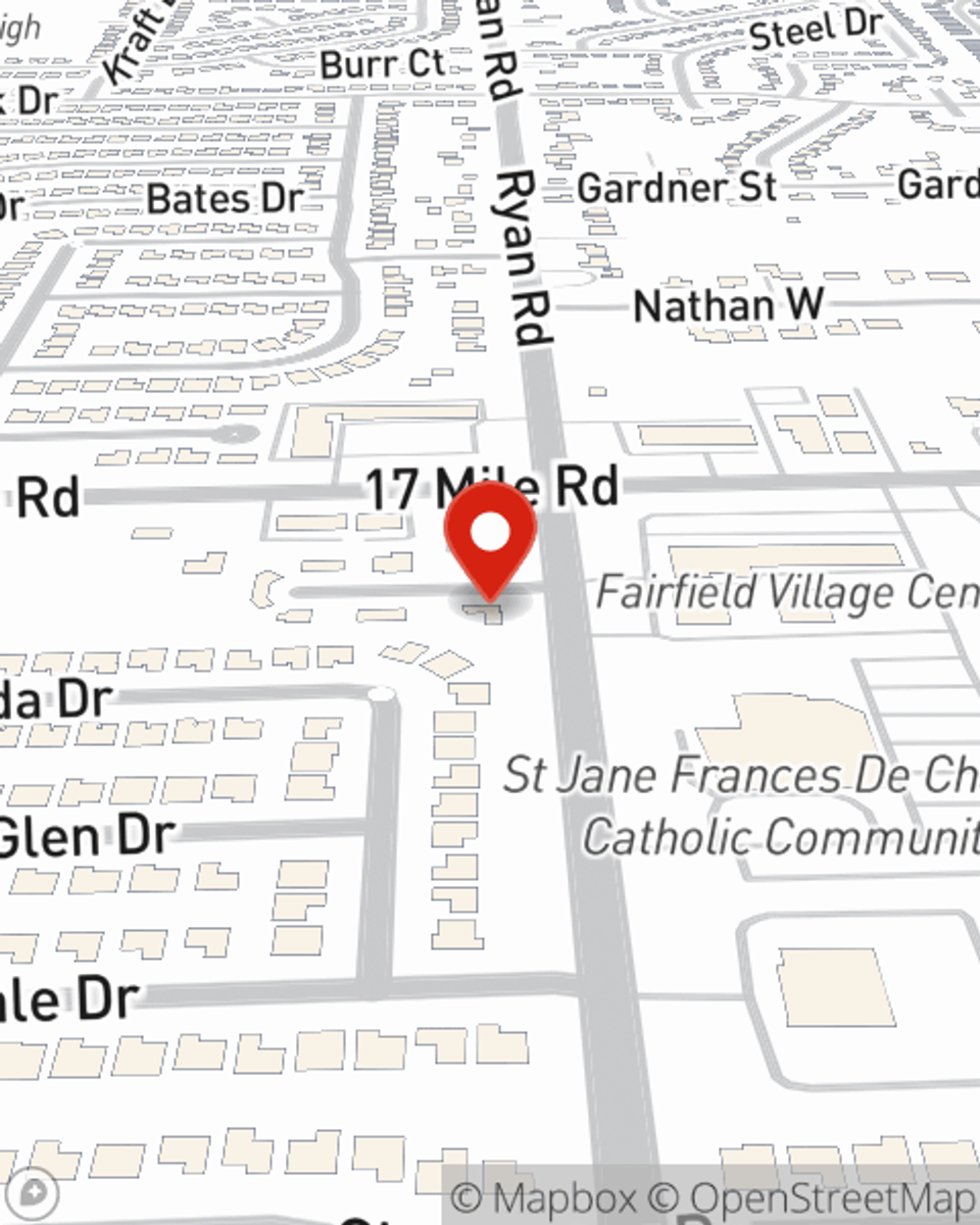

Business Insurance in and around Sterling Heights

One of the top small business insurance companies in Sterling Heights, and beyond.

Cover all the bases for your small business

- Metro Detroit

- Sterling Heights

- Michigan

- Macomb County

- Macomb

- Clinton Township

- Royal Oak

- Rochester Hills

- Detroit

- Madison Heights

- St. Clair County

- Chesterfield

- New Baltimore

- Troy

- Auburn Hills

- Romeo

- Eastpointe

- Oakland County

- Wayne County

- Dearborn

- Southfield

- Warren

- St. Clair Shores

- Grosse Pointe

State Farm Understands Small Businesses.

Do you own a confectionary, a HVAC company or a bakery? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

One of the top small business insurance companies in Sterling Heights, and beyond.

Cover all the bases for your small business

Cover Your Business Assets

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Art Donovan. With an agent like Art Donovan, your coverage can include great options, such as worker’s compensation, commercial auto and artisan and service contractors.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Art Donovan's team to discover the options specifically available to you!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Art Donovan

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.